VAT RELIEF UK

VAT exemption is available to customers in the UK who wear wigs and hairpieces for ‘necessity reasons’. These apply to customers who require wigs or hairpieces due to alopecia, hair loss as a result of chemotherapy treatment or any other medical condition that causes hair loss where a GP confirms in writing that the customer is a ‘necessity wearer’.

If you are in any doubt as to whether you are eligible to receive goods or services zero-rated for VAT you should consult Notice 701/7 VAT reliefs for disabled people at www.hmrc.gov.uk or by contacting the VAT Disabled Reliefs Helpline on 0300 123 1073 before signing the declaration made available to you as part of the ordering process. Please note, there are penalties for making false declarations.

We are unable to refund any VAT after the order has been confirmed, processed and dispatched.

How it works:

1: Decide which Topper you intend to purchase.

2: Download your eligibility declaration form here.

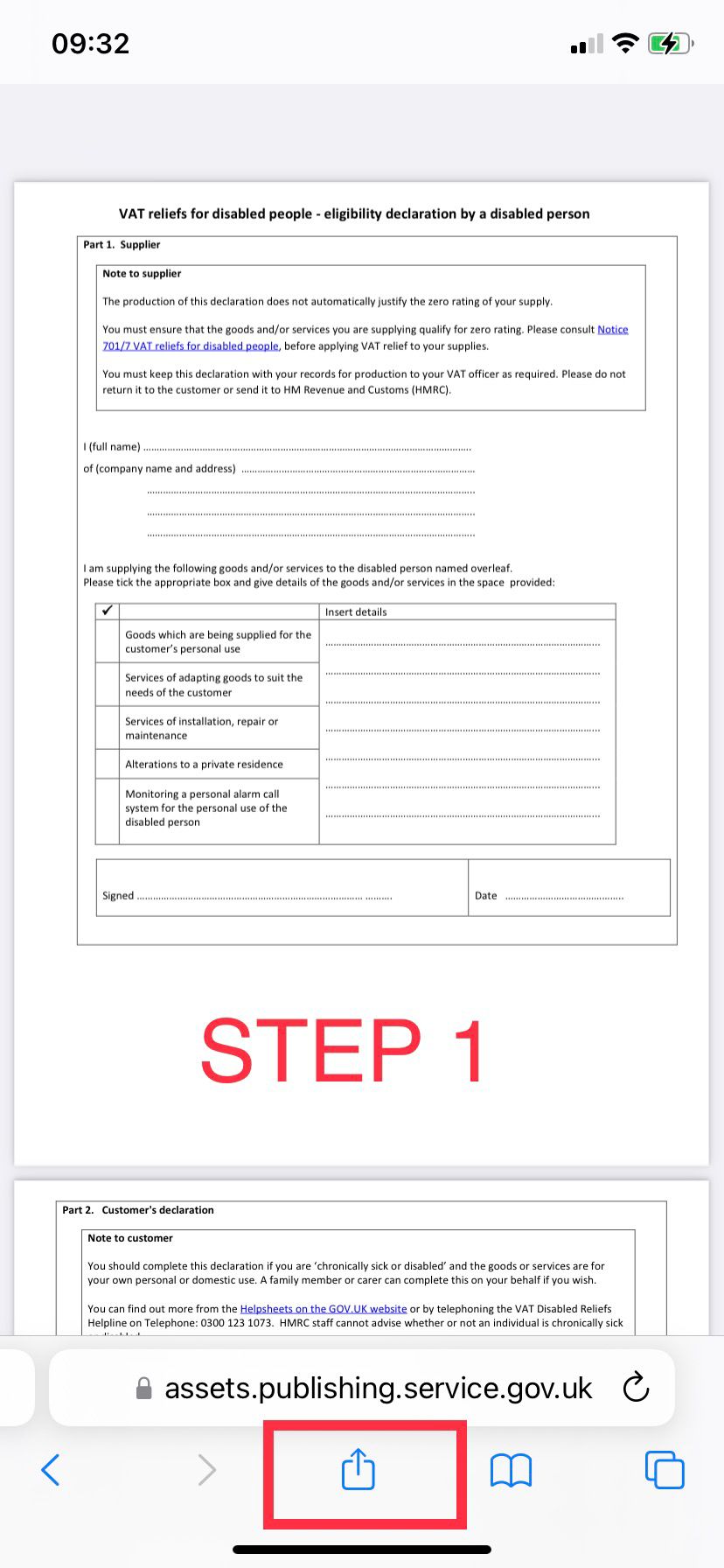

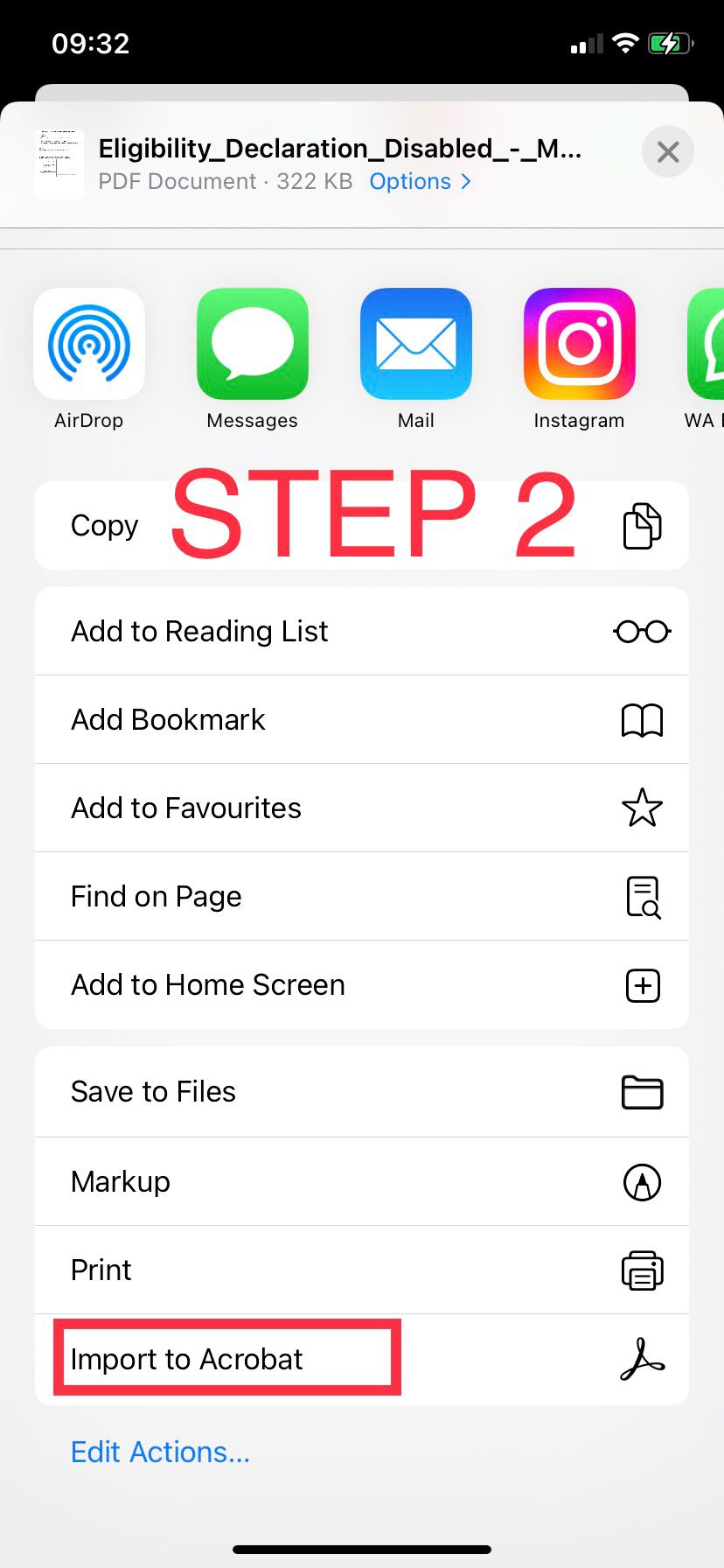

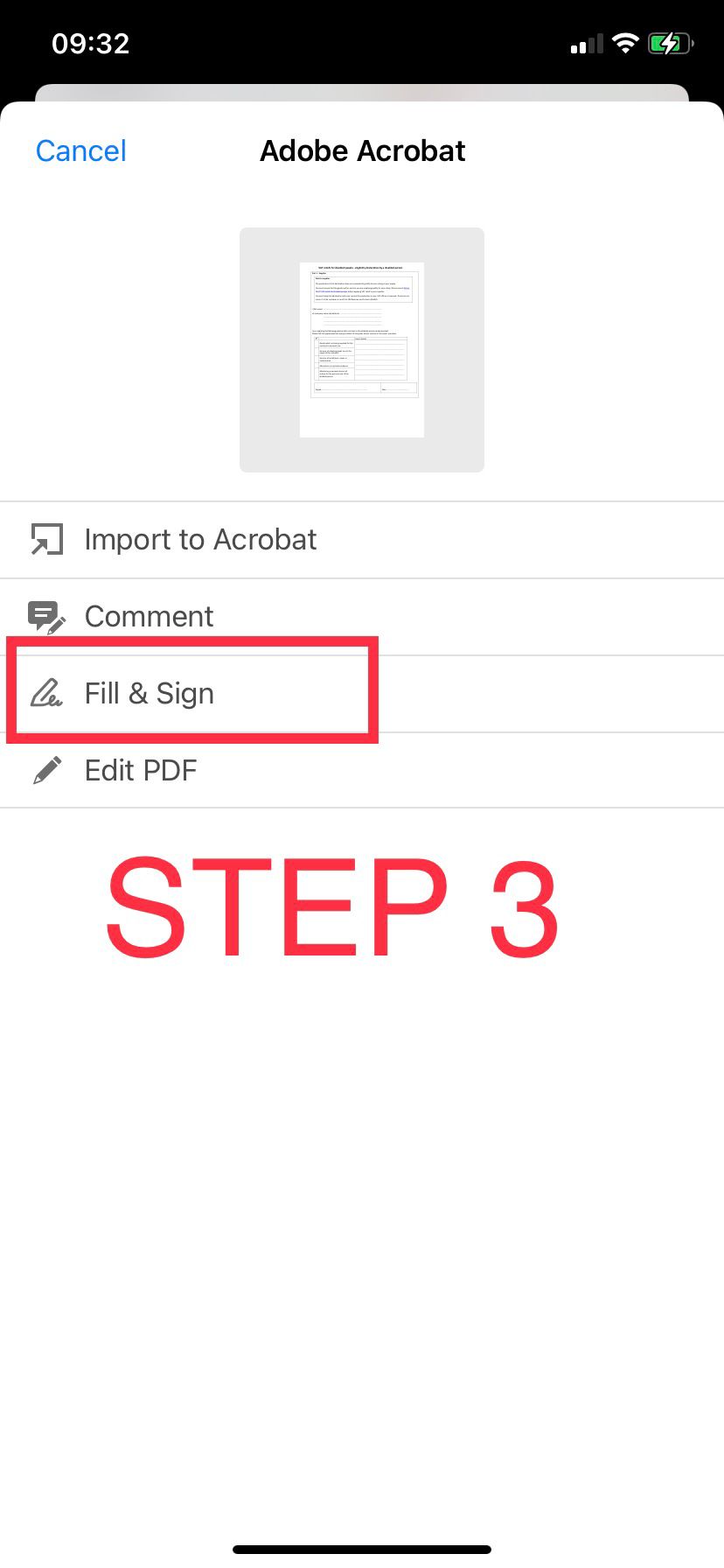

If you experience difficulty writing over the PDF HMRC form, we advise you download the “Adobe Acrobat” app which will enable you to write over the form (see steps 1, 2, 3 in our easy to follow images).

3: Carefully fill out your form, then email this back to us along with which Topper you wish to purchase.

We cannot accept screen shots or images of the form, we require it to be uploaded via email or WhatsApp.

*The VAT relief date needs to match the order form date, please only send the form once ready to place your order*

4: Once we are in receipt of your completed form, we will personally guide you towards completing your purchase minus VAT 20%.

Vat Relief in the Uk is calculated using a VAT calculator.